Navigating in the intricacies of WBSO (Damp Bevordering Speur- en Ontwikkelingswerk) administration may be a daunting process For several companies. From accurately documenting R&D functions to complying with stringent reporting requirements, managing WBSO can consume beneficial time and means. On the other hand, with the right resources and answers set up, corporations can streamline their WBSO administration processes, saving time and making certain compliance. Enter Traqqie – your greatest spouse in simplifying WBSO administration.

Precisely what is WBSO and Why is Right Administration Vital?

WBSO is actually a tax incentive supplied by the Dutch govt to really encourage innovation in organizations. It offers a discount in wage tax or national insurance policy contributions for suitable R&D projects. On the other hand, accessing these benefits requires meticulous administration and adherence to precise rules established through the Dutch tax authorities. Failure to maintain correct WBSO administration may lead to skipped incentives, economic penalties, or perhaps audits.

The Difficulties of WBSO Administration:

Documentation Burden: Businesses should sustain thorough documents in their R&D pursuits, together with challenge descriptions, several hours labored, and technological breakthroughs.

Compliance Complexity: Navigating the intricate guidelines and laws of WBSO may be mind-boggling, specifically for businesses with restricted skills in tax matters.

Threat of Errors: Guide information entry and calculation improve the risk of mistakes, bringing about likely compliance problems and financial setbacks.

Time-Consuming Procedures: Common ways of WBSO administration involve important time and effort, diverting sources from Main company actions.

How Traqqie Simplifies WBSO Administration:

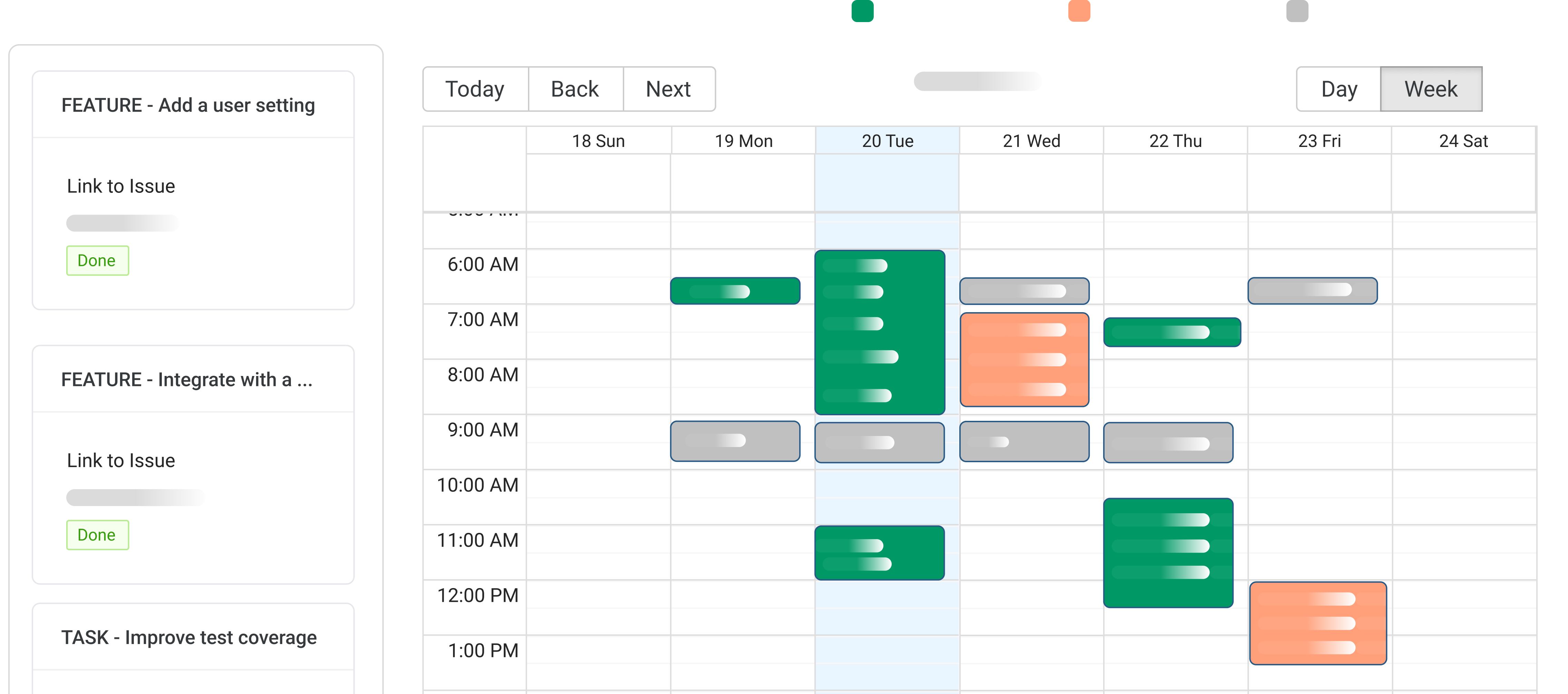

Automatic Documentation: Traqqie automates the documentation system by capturing serious-time data on R&D actions, removing the need for handbook report-keeping.

Comprehensive Compliance: With Traqqie, corporations can make certain compliance with WBSO laws as a result of designed-in checks and validations, cutting down the chance of faults and penalties.

Successful Reporting: Make accurate WBSO stories effortlessly with Traqqie's intuitive reporting resources, preserving time and methods.

Streamlined Workflow: Traqqie streamlines the entire WBSO administration workflow, from undertaking registration to submission, producing the procedure seamless and stress-free.

Great things about Making use of Traqqie for WBSO Administration:

Time Discounts: By automating repetitive tasks and simplifying procedures, Traqqie can help organizations conserve precious time that can be reinvested into innovation and wbso growth.

Enhanced Precision: Reduce the risk of faults and guarantee correct WBSO claims with Traqqie's Superior validation mechanisms.

Price Efficiency: Lower administrative prices associated with WBSO administration and maximize the return on your R&D investments.

Peace of Mind: With Traqqie managing your WBSO administration, you might have comfort realizing that the compliance obligations are being fulfilled efficiently.

Summary:

Efficient WBSO administration is crucial for businesses wanting to leverage tax incentives to gas their innovation efforts. With Traqqie, companies can simplify WBSO administration, streamline processes, and assure compliance effortlessly. Say goodbye on the complexities of WBSO administration and hello to a far more effective and productive technique for managing your R&D incentives with Traqqie.